Investment Structures

Investment Structures

At Chan & Naylor Melbourne, we focus on improving four key areas – for property investors and business owners – that other comparable investment structures, don’t adequately cover:

- Asset protection for better risk management

- Flexibility for improved cash flows, income / loss distributions and optimised Tax Planning

- Longevity for preservation and transfer of wealth from generation to generation

- Control for more effective wealth creation strategies

Our range of investment structures suits a variety of asset classes and investment requirements:

- Tailored structures and agreements for joint venture property developers

- Flexible business ownership and operating structures for: small business owners, medical professionals, family operated businesses with commercial property and other assets; and larger businesses with multiple business partners.

- Enterprise structures for entrepreneurial individuals with multiple business entities and complex investment portfolio including property and shares.

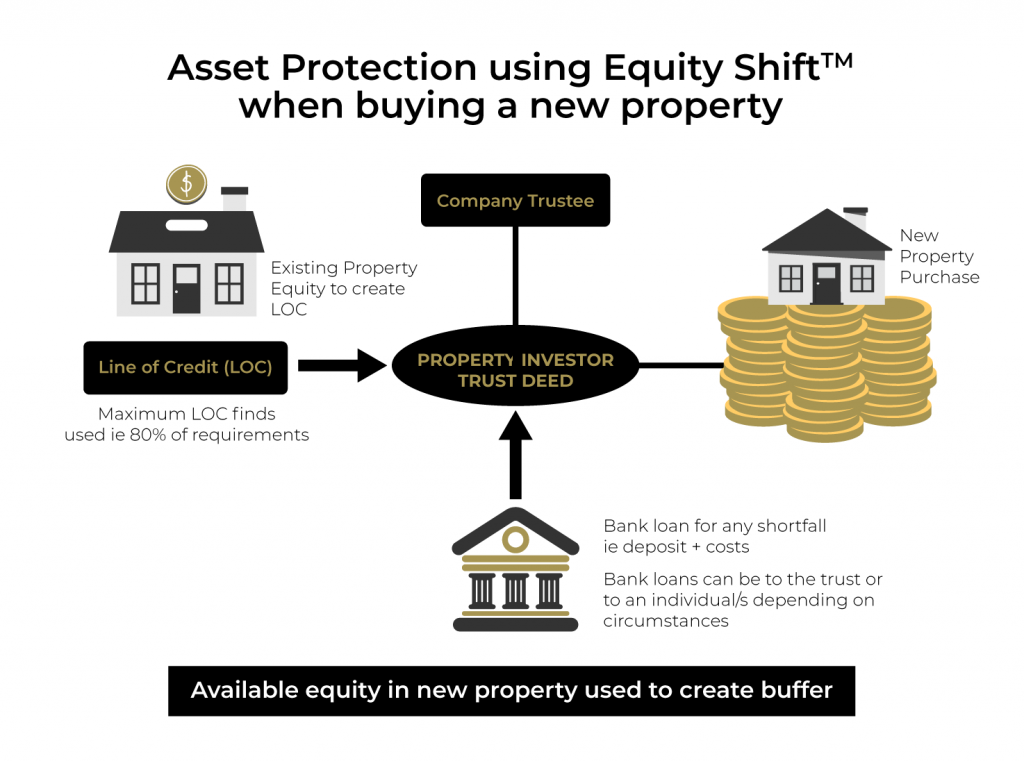

Equity Shift™

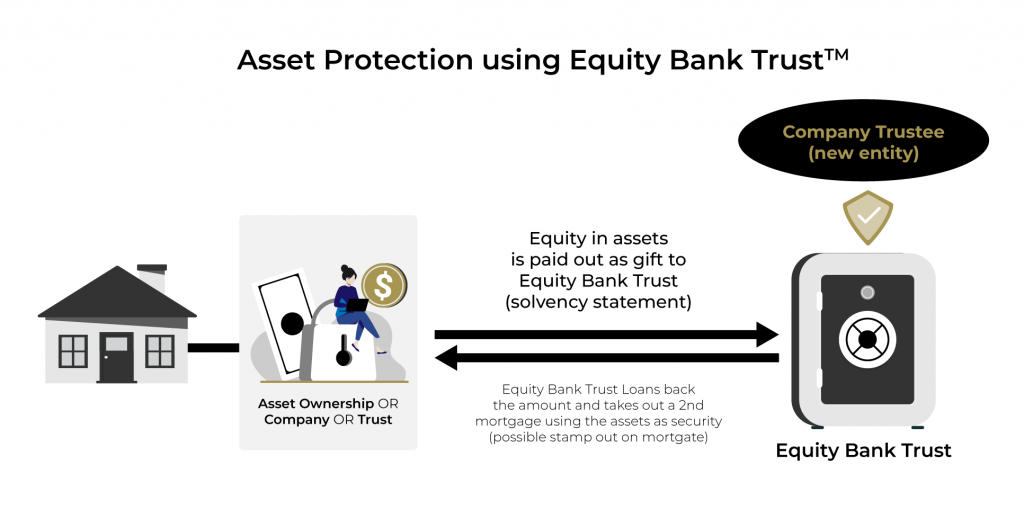

Equity Bank Trust™

The Equity Bank Trust™ (EBT™) takes on the role of a lender and places a second mortgage on your assets, thereby reducing your equity to nil. It is your equity that a lawsuit goes after not the asset, so the preservation of your equity (net wealth) is the primary consideration in asset protection.

No CGT or stamp duty on the assets is triggered. Depending on the second mortgage documentation there may be stamp duty on the mortgage document that is a small percentage of what would be the case on the asset.

Business Restructure Trust™

This strategy creates asset protection as the assets are now effectively in a trust. Once in the trust, any income or profits are capable of being directed to other individuals or trusts. Most states, other than Queensland, would have no stamp duty applied. Appropriate documentation needs to be prepared and executed showing solvency statements and the confirmation that there are no potential litigations pending. The cost of the various strategies must also be considered against the benefits.

Main Residence Trust™

It is critical to note that interest deductions on money you borrow to purchase the property, being your home, would not be deductible as it is considered private/personal expenditure.

Care must be taken in the drafting and execution of these strategies and in particular the relevant claw back provisions of the bankruptcy legislations, which would require a four-year waiting period from the commencement of the strategy until asset protection is fully available. This time period is the window within which a receiver in bankruptcy can go back to unravel any strategy. Appropriate documentation should also be prepared and executed showing solvency statements and the confirmation that there are no potential litigations pending. The cost of the various strategies must also be considered against the benefits.

Business Enterprise Trust™ (BET™)

The Chan & Naylor Business Enterprise Trust™ (BET™) is a business specific Trust with discretionary capabilities. It is a flexible business structure with advanced asset protection and estate planning features.

The BET™ provides an efficient and effective operational and functional support for people operating a business either in a single family or with third party partners (requires additional documentation).

The BET™ is an ideal structure for family owned generational businesses.

Features & Benefits

- Flexible distributions to nominated beneficiaries.

- On sale of the business, the beneficiaries would be entitled to 50% CGT General Discount and Small Business

- Concessions after meeting normal taxation rules.

- Can be used to buy positively geared properties.

- Allows for the entry of a new business partner. They would set up their own BET™ and then the two would operate under a Partnership of Trust Agreement (which Chan & Naylor can arrange). Benefits include:

Chan & Naylor provides full documentation including the Business Enterprise Trust™ , completion of the various Registrations, full compliance reporting including accounting and taxation.